In a Rare Letter to the Confederate House and Senate, President Jefferson Davis Initiates the Last Financial Gasp of the Confederate War Effort

He places before the Confederate Congress the report on finances that immediately led to the Funding Acts of 1864, which sought to raise funds for the war through taxes and bonds, and also stem inflation .

The measures came too late, and there would not be time to try anything of their magnitude again

The antebellum South enjoyed one of the lightest tax burdens of all contemporary civilized societies. Local or state governments assessed all of the obligations. By contrast, the hastily assembled Confederate government lacked the bureaucratic...

The measures came too late, and there would not be time to try anything of their magnitude again

The antebellum South enjoyed one of the lightest tax burdens of all contemporary civilized societies. Local or state governments assessed all of the obligations. By contrast, the hastily assembled Confederate government lacked the bureaucratic infrastructure to levy or collect internal taxes. Its citizens possessed neither a tradition of compliance nor a means to remit payment. Land and slaves comprised the bulk of Southern capital; liquid forms of wealth like gold or paper currency were hard to come by in a predominantly agrarian region.

Efforts to raise war revenue through various methods of taxation proved ineffective. The Confederate Congress enacted a minor tariff in 1861, but it contributed only $3.5 million in four years. That same year, Congress implemented a small direct tax (0.5%) on real and personal property. But the government in Richmond was forced to rely on the individual states to collect the levy. Reprising the scenario played out during the Revolutionary War, most states did not collect the tax at all, preferring to meet their quota by borrowing money or printing state notes to cover it.

The Davis administration turned to loans to finance the initial bulk of war debts. Riding a wave of patriotic enthusiasm in 1861, the Treasury earned $15 million selling out their first bond issue. The second issue, however, consisting of $100 million in 8% yield bonds, sold slowly. By necessity rather than choice, the South turned to the printing press to pay most of its bills. In its first year, the Confederate government derived 75% of its total revenue from printing and issuing Treasury notes that had no hard money backing them up, less than 25% from bonds (purchased, of course, with the notes), and under 2% from taxes. While the proportion of the latter two would increase slightly in later years, the foundation of Confederate war financing consisted of over $1.5 billion in paper dollars that began depreciating before the ink had a chance to dry.

By the spring of 1863, the crushing burden of inflation motivated Richmond to come up with an alternative. In April, they followed the lead of the Lincoln Administration and enacted comprehensive legislation that included a progressive income tax, an 8% levy on certain goods held for sale, a 10% profits tax on wholesalers, and excise and license duties. These provisions also included a 10% tax on agricultural products, which had to be paid with those products rather than cash. This burdened farmers more than the progressive income tax encumbered salaried workers, since laborers could remit depreciated currency to meet their obligations but farmers lost a portion of their crop. Adding to the inequity, the law exempted some of the most lucrative property owned by wealthy planters - their slaves - from assessment.

Early in 1864, the Confederate Treasury Department compiled a dire report on the nation’s finances and delivered it to President Davis. At that point, the economy was in a serious state, both debt and inflation were rising even higher, and there was heightened condemnation of a “rich man’s war, poor man’s fight.” Something clearly needed to be done, and done immediately. Davis placed the report before the Confederate Congress on February 12, 1864.

Letter Signed, Richmond, February 12, 1864, to the Senate and House of Representatives of the Confederate States of America. “I herewith transmit for your consideration a communication from the Secretary of the Treasury, submitting an estimate of additional Sums needed for the support of the Government. I recommend an appropriation of the amount specified for the purposes indicated. Jefferson Davis.” The Journal of the Congress of the Confederate States of America records this letter, and the fact that action on it was begun that very day.

On February 17, Congress passed and Davis signed an omnibus package of laws specifically related to taxes, currency, and loans. Moreover, since the draft was not producing sufficient recruits, a conscription bill was passed the same day.

The financial acts authorized unlimited borrowing and provided for the issuance of more Treasury notes and bonds. There was an attempt to reduce the amount of currency in the market by making bank depositors either lose a portion of their deposits or take those monies in bonds at 4% interest. Reducing the amount of currency would drive down inflation rates, as well as help fund the government to continue the war by making its dollars more valuable. As for taxes, they expanded the revenue base by increasing the span of businesses to be taxed, and the rates in different industries and services. Slaves were finally taxed to reduce the perceived preference of the tax laws for the wealthy, though the tax was at 5% as opposed to a range of 10%-25% on profits. The conscription act allowed the draft of men between the ages 17 to 50, up from 18 to 45.

These changes came too late, however, to have any sustained impact on the Confederate war effort. By the time some of then were implemented in April 1864, General U.S. Grant was readying to launch his Overland Virginia Campaign. A year later the war would be lost, and all the Confederate notes and bonds rendered valueless.

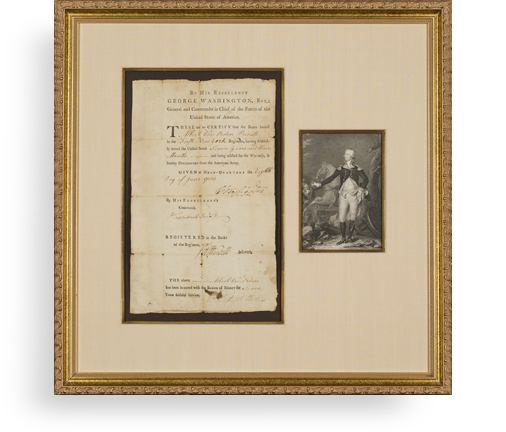

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services