Secretary of the Treasury Alexander Hamilton Issues an Opinion on the Distinction Between Foreign and Domestic Trade

In a 1789, 3-page letter, he clarifies provisions for revenue collection in the early laws of the Treasury Department

“The question then is: What is to be deemed a trading between the districts?”; This document has never before been offered for sale

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise monies. A main goal of...

“The question then is: What is to be deemed a trading between the districts?”; This document has never before been offered for sale

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise monies. A main goal of the new U.S. Constitution was the correction of that defect, and with the support of advocates like Alexander Hamilton and James Madison, it established a means to fund the country by authorizing Congress to collect taxes to raise revenue. This revenue would come mainly from tariffs and tonnage duties on goods coming into the U.S., which would be collected at customs houses at the ports of entry. On July 4, 1789, an act was passed formalizing this, allowing for the collection of import duties. The Collectors of these customs houses were appointed by President George Washington, and were men of substance who could be relied on (for example, Signer of the Declaration of Independence William Ellery was the first Collector in Newport, R.I.). In September of 1789, in one of the first substantial Acts of Congress passed and signed by President Washington, the U.S. Treasury was formed. That same month, Alexander Hamilton became the first U.S. Treasury Secretary. This put in place an agency to handle the nation’s finances.

Hamilton turned to creating a system that would stand the test of time. In September 1789, Congress passed “An Act for Registering and Clearing Vessels, Regulating the Coasting Trade, and for other purposes.” The customs houses scattered in the major port towns throughout the states were the front lines, assessing and measuring cargo, determining value, and collecting the taxes, as well as disbursing funds. Among these was the district of Machias, now part of Maine, one of the northern most ports in the United States, with Stephen Smith as Collector.

Vessels were constantly coming and going, some going from one domestic port or district to another, and others dropping or gathering goods for foreign trade. The treatment of tariffs and other taxes imposed on the trade of goods varied greatly depending on whether those goods were destined for foreign consumption or were made abroad and imported. When vessels traveled from one district to another, their intent was not always clear but this was an important distinction, as repaying debt rested heavily on the ability to collect those tariffs.

Hamilton also needed to clarify whether the collectors were to take their own assessment of the weight of foreign vessels or take the captains’ word for it. The heavier the vessel the more revenue they paid.

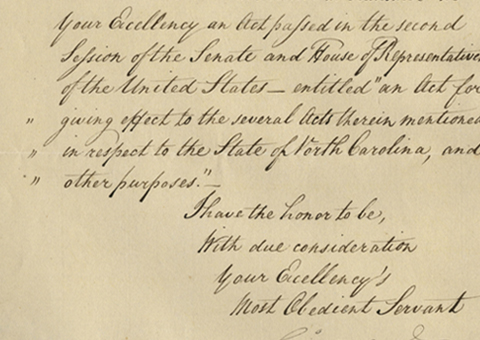

Letter signed, 3 pages, Treasury Department, December 23, 1789, to Stephen Smith, Collector of Machias. “Sir, My opinion having been several times asked on the following points, I think it proper in order to produce uniformity of practice to convey it in a Circular Instruction.

“First – Whether the tonnage of foreign vessels ought to be taken from the Registers, or ascertained by admeasurement according to the principles of the third Section of the act for registering &c.

“I am of opinion that the latter ought to be the case, not only because it is agreeable to the letter of that Section which is general, but because it cannot be presumed that the Legislature intended to favor foreign vessels in this respect, which would be the case, if the Tonnage expressed in their registers should govern; as the mode of admeasurement prescribed by our law makes the Tonnage greater than that which prevails in other Countries.

“Secondly. Whether a vessel not licensed as a Coaster, or for the fishing trade, going from one district to another shall enter & pay tonnage at the last? And at what rate?

“I am of opinion that there must be an entry in each district and that the entry will draw with it the payment of Tonnage in each. But the rate will depend on the circumstances. If there be nothing to constitute a trading between the districts within the meaning of the last clause of the twenty third Section of the Coasting Act, the rate of tonnage in each district will be the same & will be determined by the particular description of the Tonnage Act, under which the Vessel may fall.

“But if there be such a trading between the districts the rate of tonnage will be fifty Cents.

“The question then is – What is to be deemed a trading between the districts? Without attempting a precise definition of the thing, I will state, as a guide, some cases which in my opinion are, or are not so.

“First – If a vessel arriving from abroad at one district with a Cargo proceeds with the whole or a part of that identical Cargo to another district, I do not conceive this to be a trading between the districts.

“Secondly – If a vessel bound to a foreign port takes in part of her outward Cargo at one district and proceeds to another to take in another part of her outward Cargo, this also is not in my opinion, a trading between the districts.

“But Thirdly – If in any case a vessel not licensed as aforesaid take in a freight at one district to be delivered at another, this is to be deemed a trading between the districts and subjects her to the rate of foreign Tonnage.”

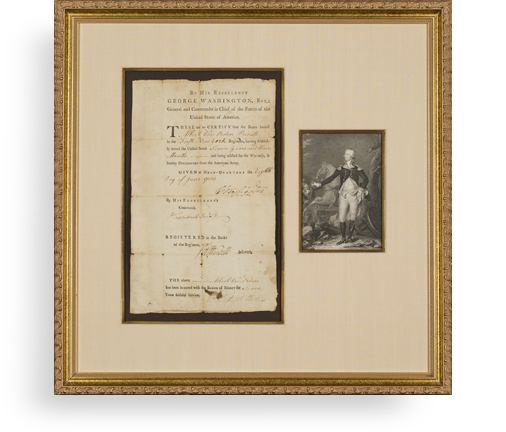

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services