Alexander Hamilton Extends His Revenue and Commerce System to the Newest State to Ratify the Constitution, Citing the Great Document by Name and Article

"The Federalist" author offers his Constitutional interpretation for his decision: "Among other reasons for this opinion is that Article of the Constitution which declares that all duties imports and excises shall be uniform throughout the United States.

The Constitution was adopted on September 17, 1787 by a Constitutional Convention meeting in Philadelphia, PA. What followed was an arduous and often contentious process of ratification by special state conventions. Ratification was not a forgone conclusion; there was serious criticism from the anti-federalists, who argued that it granted the national government...

The Constitution was adopted on September 17, 1787 by a Constitutional Convention meeting in Philadelphia, PA. What followed was an arduous and often contentious process of ratification by special state conventions. Ratification was not a forgone conclusion; there was serious criticism from the anti-federalists, who argued that it granted the national government too much power. Others complained of the lack of a Bill of Rights. In the end, the Federalists, with Alexander Hamilton playing a strong leadership role, managed to sway opinion in favor of the Constitution, arguing the power granted was reasonable and necessary, and that a Bill of Rights could be implemented as an amendment after ratification. Hamilton, James Madison and John Jay wrote essays, now renowned as "The Federalist Papers," which successfully made the case for the new Constitution and government.

Only 9 states needed to ratify the Constitution for it to take effect, and 11 states had done so by July 1788. The U.S. government thus authorized was put in place in April 1789, when President Washington, Vice President Adams, and the Cabinet members took their oaths of office. Among these was Alexander Hamilton, who took on the role of the highly influential Secretary of the Treasury. In this capacity, he would conceptualize, formulate and implement the country's financial system. His program would ensure that the U.S. would have money to pay its war debts, leave states strong enough money to do the same, and supervise a system for the collection of revenue to fund the federal government via strong duties on imports that would, for the first time, function nationwide.

Two states remained that had not ratified the Constitution: Rhode Island, which had voted against the document out of fear that, as a tiny state, it would be swamped by the larger states, and North Carolina, which opposed an overly centralized government. So even as the Union under the Constitution proceeded, they remained on the outside, meaning that the work of nation building was incomplete. Moreover, their holding out had great practical implications for Hamilton, who stood astride American financial affairs. Specifically, in July 1789, among the first Acts of Congress signed by Washington had been "An Act to Regulate the Collection of the Duties imposed by law on the tonnage of ships or vessels and on goods, wares and merchandises imported into the United States." This was called the "Collection Bill" and was how America would get its money to fund projects, supply its national defense and otherwise run the government. It was the lifeblood of the new nation and under Hamilton's purview.

So how would this work with two states subject to different regulations? Section 38 of the Collection Bill explained that "The States of Rhode Island and Providence Plantations and of North Carolina have not as yet ratified the present Constitution of the United States, by reason whereof this act doth not extend to the collecting of duties within either of the said two states…"; Section 39 stated that the federal government would collect duties from those states as if they were foreign countries: "All goods, wares and merchandise not of their own growth or manufacture, which shall be imported from either of the said two States of Rhode Island and Providence Plantations, or North Carolina, into any other port or place within the limits of the United States… shall be subject to like duties, seizures and forfeitures, as goods, wares or merchandise imported from any state or country without said limits." A subsequent Act adopted just 2 months later also allowed duties to be placed on "rum, loaf sugar, and chocolate" emanating from these two states as if they were sovereign entities.

In November 1789, fearing less a federal government they already saw in place, and with a Bill of Rights already proposed in Congress, North Carolina finally ratified the Constitution. It was left to Hamilton to determine the Constitutional implications of North Carolina's adoption as they related to the Treasury and collection of revenue, and to notify his Treasury Department officials of its implications and how North Carolina would be incorporated into the Treasury apparatus.

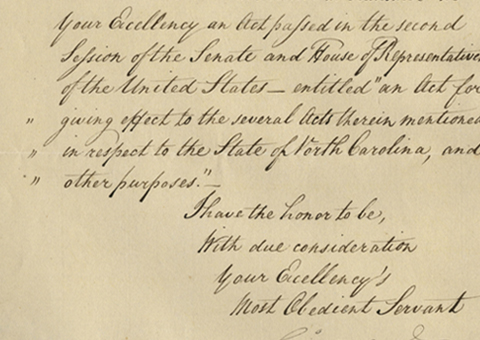

Letter signed, as Treasury Secretary and on Treasury Department letterhead, New York, January 27, 1790, offering his Constitutional opinion and issuing his instructions. "The adoption of the Constitution of the United States by the State of North Carolina, having raised a question concerning the operation of the 39th -Section of the Collection bill and the 3d Section of the Act for suspending part of that Act, and for other purposes: it is incumbent upon me to give my opinion upon the subject which is, that those Clauses were virtually repealed by that adoption. Among other reasons for this opinion is that Article of the Constitution which declares that all duties imports and excises shall be uniform throughout the United States."

Article I Section 9 of the U.S. Constitution states, "No preference shall be given by any regulation of commerce or revenue to the ports of one state over those of another."

Letters of any founders mentioning the Constitution are very uncommon, and those discussing interpretation of its central premises even more so. That this letter is signed by Hamilton and relates to this revenue collection system is all the more remarkable.

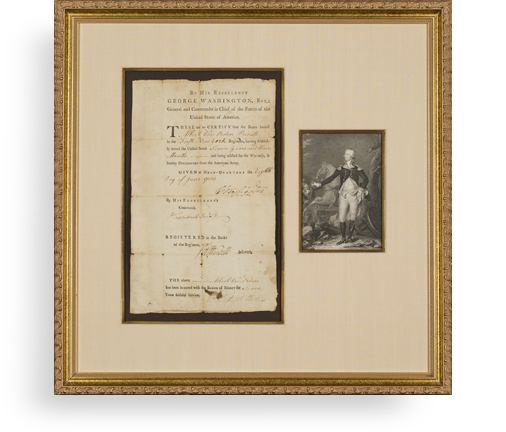

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services