President James Madison and Secretary of State James Monroe Appoint Commissioners to Fund the Second Bank of the United States

They name some of Massachusetts’ most prominent citizens to handle the effort there

This is a real rarity, being the first document we have encountered appointing commissioners to fund the Bank, and a search of public sale records discloses no others

During and in the immediate aftermath of the War of 1812, the U.S. economy suffered from an unstable money supply and inadequate credit availability,...

This is a real rarity, being the first document we have encountered appointing commissioners to fund the Bank, and a search of public sale records discloses no others

During and in the immediate aftermath of the War of 1812, the U.S. economy suffered from an unstable money supply and inadequate credit availability, as the result of an unregulated currency and lack of fiscal order. A national clamor arose to legislate a central bank to address these needs. Such a bank – called the Second Bank of the United States – was chartered by Congress, with the act being signed into law by President James Madison on April 10, 1816. This was the second Federally authorized bank in the United States, and it existed from 1816 to January 1836, when its arch foe Andrew Jackson saw to its demise.

The Bank was a private corporation with public duties. The essential function of the bank was to regulate the public credit issued by private banking institutions through the fiscal duties it performed for the U.S. Treasury, and to establish a sound and stable national currency. The Federal deposits endowed the Bank with its regulatory capacity. It handled all fiscal transactions for the U.S. government, and was accountable to Congress and the U.S. Treasury. It was also intended to make credit more available, especially so people could buy lands opening up in the West.

Twenty percent of its $35,000,000 capital was owned by the Federal government, the bank’s single largest stockholder. Four thousand private investors would in time hold the other 80% of the bank’s capital. The bulk of this stock was held by a few hundred wealthy families, which itself would later engender opposition. In its time, the institution was the largest monied corporation in the world.

Since the Federal government held just 20% of the stock, there was an immediate need to find subscribers to fund the balance. And to solicit for such subscribers and receive their funds, commissioners needed to be appointed to achieve just that. Commissioners were named for 20 cities around the country, from Portland, Maine in the North to New Orleans in the South. The appointees were men of note, such as John Jacob Astor in New York, Constitution signer Nathaniel Gilman in New Hampshire, and former Attorney General Caesar A. Rodney in Delaware. The choices for Boston were: Nathaniel Silsbee, a merchant who would soon serve in the House of Representatives and U.S. Senate, and be a Bank director (and whose wife was one of supremely wealthy Crowninshields); William Gray, the wealthiest man in New England, with a private fleet of 60 square-rigged vessels; and John Parker, a wealthy merchant whose portrait was painted by Gilbert Stuart.

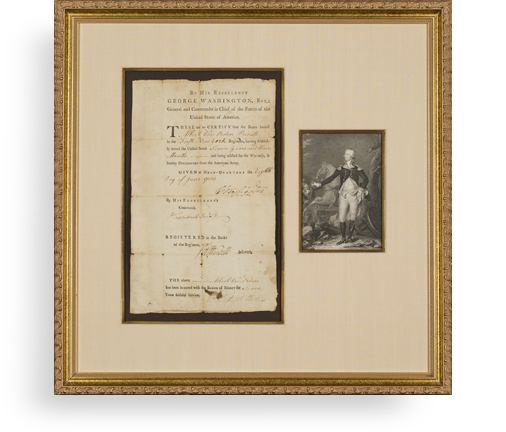

Document signed, Washington, April 23, 1816, appointing William Gray, John Parker and Nathaniel Silsbee Bank commissioners. “By virtue of the Act of Congress entitled ‘An Act to incorporate the Subscribers to the Bank of the United States’, I…Do by these presents appoint you, the said William Gray, John Parker and Nathaniel Silsbee to be commissioners for superintending the Subscriptions towards constituting the Capital of the said Bank of the United States to be opened on the first day of July next…” The document is countersigned by James Monroe as Secretary of State. Monroe would succeed Madison as President less an a year later.

This is the first document we have ever encountered appointing commissioners to fund the Second Bank of the United States. Moreover, a search of public sale records going back 40 years fails to disclose even one. With so few issued in the first place, and many probably not surviving, this is hardly surprising.

Within the first three years, the bank was nearly ruined due to mismanagement, but then things changed. Langdon Cheves was elected president of its board of directors in 1819 and restored the bank’s credit. In 1822, he resigned the post and was succeeded by Nicholas Biddle. The national charter for the bank expired in 1836, but Biddle kept the bank in operation until 1841, using a state charter.

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services