The Act of Congress That Helped Bring on the Whiskey Rebellion, Signed by Thomas Jefferson as Secretary of State

The law made a nod towards opponents by lowering some duties on whiskey, but set up a stringent enforcement scheme that would just two years later result in an uprising in Western Pennsylvania

Putting down the Whiskey Rebellion was the first demonstration that the Federal government could maintain control and authority within state boundaries

As part of the compromises that led to the adoption of the U.S. Constitution in 1789, the new Federal government agreed to assume the Revolutionary War debts of the 13 States....

Putting down the Whiskey Rebellion was the first demonstration that the Federal government could maintain control and authority within state boundaries

As part of the compromises that led to the adoption of the U.S. Constitution in 1789, the new Federal government agreed to assume the Revolutionary War debts of the 13 States. To help pay for this newly-assumed debt, Secretary of the Treasury Alexander Hamilton proposed an excise tax on domestically produced whiskey in his “Report Relative to a Provision for the Support of Public Credit,” which he submitted to Congress in 1790. In early 1791, Congress used its new constitutional authority to “lay and collect Taxes, Duties, Imposts and Excises” and passed the first nationwide internal revenue tax—an excise tax on distilled spirits. Unlike tariffs paid on goods imported into the United States, the excise tax on distilled spirits was a direct tax on Americans who produced whiskey and other alcohol spirits. The 1791 excise law set a varying 6 to 18-cent per gallon tax rate, with smaller distillers often paying more than twice per gallon what larger producers paid. All payments had to be made in cash to the Federal revenue officer appointed for the distiller’s county. Large, commercial distillers in the eastern United States generally accepted the new excise tax since they could pass its cost onto their cash-paying customers. However, most smaller producers west of the Appalachian and Allegheny Mountains, then the nation’s frontier, opposed the whiskey tax.

While eastern farmers could readily transport their grain to market, westerners faced the hard task of moving their crops great distances to the east over the mountains along poor dirt roads. Given this difficulty, many frontier farmers distilled their surplus grain into more easily transportable whiskey. In doing so, their grain became taxable distilled spirits under the 1791 excise law, and western farmers opposed what was, in effect, a tax on their main crop. Usually cash-poor, frontier residents also used whiskey to pay for the goods and services they needed. Other aspects of the excise law also caused them concern. The law required all stills to be registered, and those cited for failure to pay the tax had to appear in distant Federal, rather than local, courts. In Pennsylvania the only Federal courthouse was in Philadelphia, some 300 miles away from the small frontier settlement of Pittsburgh. In addition, many were upset by what they saw as the national government’s inattention to continuing Indian attacks along the frontier and, with Spain’s control of New Orleans, westerners were frustrated with the failure of the government to open the Mississippi River to free American trade.

From the beginning, the Federal government had little success in collecting the whiskey tax along the frontier. While many small western distillers simply refused to pay the tax, others took a more violent stand against it. Federal revenue officers and local residents who assisted them bore the brunt of the protesters’ ire. Tax rebels tarred and feathered several whiskey tax collectors and threatened violence to others. As a result, many western counties never had a resident Federal tax official.

To address some of the westerners’ concerns, Congress modified the excise act in May 1792 with “An Act concerning the Duties on Spirits distilled within the United States.” This reduced the duties somewhat and replaced the broad tax on whiskey and stills with one limited to “all spirits which…shall be distilled within the United States wholly or in part from molasses, sugar or other foreign materials”. But while the former provision was some help, the latter was a scant concession indeed, if it was one at all. The act also provided that all stills must be registered, and that federal inspectors would visit the stills and mark the casks. “Every distiller of, and dealer in spirits,” the act read, “who may have in his or her possession, distilled spirits not marked or certified, shall be liable to seizure and forfeiture…” Importantly, the act involved the President in the whole matter of whiskey duties. “The President of the United States be authorized to make such allowances for their respective services to the supervisors, inspectors and other officers of inspection, as he shall deem reasonable and proper…”

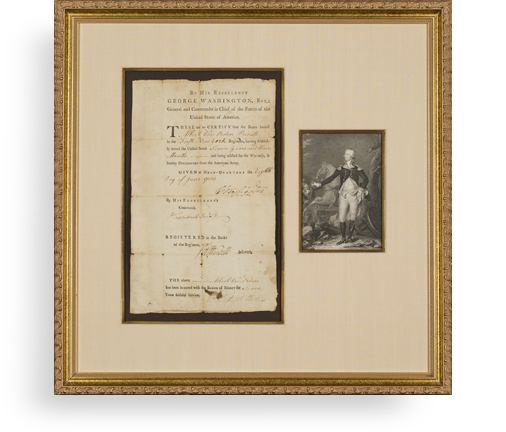

Document signed, an original Act of Congress, Philadelphia, May 8, 1792, being that very law: “An Act concerning the Duties on Spirits distilled within the United States.” It is signed by Thomas Jefferson in his role as Secretary of State. On a personal level, Jefferson opposed the tax, and in time would end it.

Opposition to this tax remained strong, and as of August 1792, the Federal government had failed to collect any taxes from the main areas of opposition. President Washington took notice of the resistance to the whiskey tax and issued a proclamation on September 15, 1792, condemning interference with the “operation of the laws of the United States for raising revenue upon spirits distilled within the same.” Despite the President’s plea and Congressional modification of the excise law, violent opposition to the whiskey tax continued to grow over the next two years.

In July 1794, a force of some 500 disaffected whiskey rebels attacked and destroyed the home of a tax inspector just south of Pittsburgh. The rebellion grew in numbers until there were a few thousand men involved, and it threatened to spread to other states. Hamilton argued that the presence of a large and potentially hostile force in Pennsylvania could not be tolerated, and that if the Federal government were to survive, it would have to show itself capable of maintaining control. President Washington instead put state militias on the ready and sent in negotiators. But when talks proved fruitless, Washington acquiesced to Hamilton’s view. A force of 13,000 state militia troops, led by Washington himself (it marked the first and last time a sitting president led armed troops), marched into Western Pennsylvania. By the time the Federal force arrived, the rebellion had essentially collapsed and most of the rebels had fled. In the end two men were convicted of treason and later pardoned by Washington. But the Whiskey Rebellion was a key development in U.S. history, both because the Federal response was a critical test of national authority (and one which Washington’s fledgling government met with success), and the actions of the states in providing militias showed they would support the national government against rebels in their own borders.

The whiskey tax that inspired the rebellion continued to be almost impossible to collect. But it remained in effect until 1802, when under the leadership of President Thomas Jefferson and his party (which opposed Hamilton’s tax policies), the tax was repealed once and for all.

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services