Thomas Jefferson Assists President George Washington in Implementing Alexander Hamilton’s Great Financial Program in 1790

The passage of Hamilton's 1790 program was eased by a compromise permitting the national capital in the South, though Jefferson would later lament it and Hamilton's influence

He names the Connecticut Commissioners of Loans, who would work with Hamilton on Hamilton’s central program – the assumption of state loans by the federal government

https://raab-collection-uploads.storage.googleapis.com/wp-content/uploads/20231204112709/Untitled-9.mp4

In September 1789, President George Washington assigned Alexander Hamilton the task of solving the nation’s debt. As Secretary of the Treasury, Hamilton had 110...

He names the Connecticut Commissioners of Loans, who would work with Hamilton on Hamilton’s central program – the assumption of state loans by the federal government

In September 1789, President George Washington assigned Alexander Hamilton the task of solving the nation’s debt. As Secretary of the Treasury, Hamilton had 110 days to prepare a report on the nation’s credit status, which he would present to Congress in January 1790. Hamilton saw the national and state debt as priorities – inhibiting the establishment of a new and healthy economy, as well as preventing the government from obtaining adequate credit. Nor were the states competent to solve these debt problems on their own.

All solutions initially seemed to have roadblocks. If Hamilton shrugged off the debt as a responsibility of the states, it would discourage lenders from ever loaning to the U.S. or its states again. If he paid only notes and debts still held by their original owners, he would threaten small merchants and open the government up to case-by-case decisions. And if he paid off the debt entirely, he would need to impose the kind of taxes that had sparked Shays’ Rebellion two years prior. So Hamilton got to work creating a program that would be viable.

On January 9, 1790, Hamilton issued his famous 40,000-word First Report on the Public Credit, which called for full federal payment at face value to holders of government securities. This became the foundation for subsequent action taken by Congress for funding and paying the public debt. In the report, the foundation of Hamilton’s strategy was to consolidate the separate wartime debts incurred by the Continental Congress and the individual states into one public debt. There would thus be a national assumption of the state debt. Hamilton argued that the assumption of the states’ debt and their consolidation with the national debt would establish a sound public credit, strengthen the union, unleash private capital, and allow the use of national taxes such as the tariff to help extinguish the debt. A public debt, properly viewed, was an asset, Hamilton argued, not a liability. If it were treated responsibly, with debt holders earning a predictable income on their investments, the government would be able to raise additional revenues through public loans rather than onerous taxes. Equally important, the existence of a consolidated public debt would work to the political advantage of the national government, because it would cement the different parts of the new nation together. Rather than pay it off, he recommended the consolidation of old debts into new securities (stocks) with public revenues specifically pledged to pay their interest. Subscribers to these certificates of federal debt received a 6% stock issue, interest starting in 1791 and payable quarterly, equal to 2/3 the principal due. The final 1/3 came in the form of another 6% certificate of deferred interest that would start in 1801. Another stock certificate of 3% covered the interest due from December 31, 1789 to December 31, 1794. Hamilton’s plan was ultimately a success.

The national aspect of this plan was necessary because Hamilton held a dim view of the efficiency of state taxation efforts and was adamant about the creation of a unified national debt. The assumption of state debt would also increase the size of the national credit market Hamilton hoped to create. The market would also establish America’s international credit rating and hinder individual states from becoming too powerful in the new nation. To make his plan feasible, Hamilton would work with state commissioners of loans, who would report, and be responsible, to him and President Washington.

His report spurred an uproar, and earned the opposition of Thomas Jefferson, who was unenthusiastic about such a powerful federal government and the banking and financial interests Hamilton’s plan would empower. But in the Compromise of 1790, Hamilton won from Jefferson an agreement for the national government to take over and pay the state debts, and Jefferson obtained the national capital, called the District of Columbia, for the South. The Funding Act of 1790 that followed the compromise was concerned primarily with funding the domestic debt held by the states – the heart of Hamilton’s program.

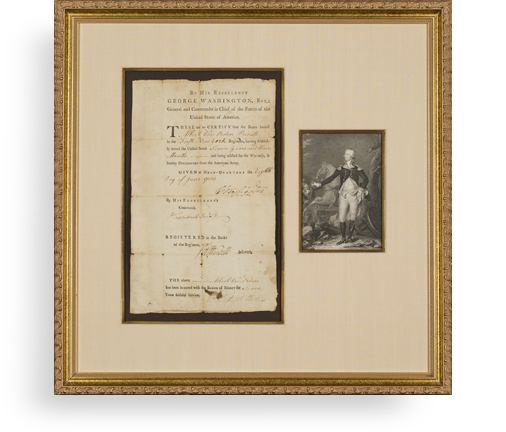

States had had Commissioners of Loans before, but now state commissioners would need to work with Hamilton directly to implement his programs. The new loan officers were called for specifically within Hamilton’s act. Manuscript document, New York, August 14, 1790, signed by Jefferson as Secretary of State, to William Imlay, sending him his commission to be Commissioner of Loans in the State of Connecticut: “Sir, The President of the United States desiring to avail the Public of your Services as Commissioner of Loans in the State of Connecticut, I have now the Honor of enclosing you the Commission, and of expressing to you the Sentiments of perfect Esteem with which I am, Sir, Your most obedient and Most humble Servant Th: Jefferson.”

Jefferson would later lament the implementation of the loan officers specifically in a famous letter to Washington, where he wrote the president that he had “never enquired what number of sons, relations and friends of Senators, representatives, printers or other useful partisans Colo. Hamilton has provided for among the hundred clerks of his department, the thousand excisemen, customhouse officers, loan officers &c. &c. &c. appointed by him, or at his nod, and spread over the Union…” As the Jefferson papers notes, “TJ’s role in arranging the famous Compromise of 1790, which involved securing congressional approval of Hamilton’s assumption plan in return for locating the national capital on the Potomac, was the political error which caused TJ the deepest regret.”

William Imlay was a New York businessman. With the outbreak of the American Revolution, and the British occupation of New York City in 1776, Imlay relocated to Connecticut, where he established a mercantile business. In 1780 the Connecticut legislature appointed him Commissioner of the Continental Loan office, a position he retained with the reorganization of the Federal government, as is seen in this letter from Secretary of State Thomas Jefferson, transmitting his appointment from President George Washington. Imlay’s reappointment under the new government was spurred by letters he sent to the President in August and September, 1789, expressing his desire to continue his public service in the Loan Office. Imlay remained in the Loan Office until his death in 1807.

This is an unusual letter in that we see Thomas Jefferson helping implement the financial program developed by his great adversary, Alexander Hamilton.

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services