Chief Justice John Marshall Issues An Extraordinary Opinion to the Secretary of the Treasury On How the Powers of the Second Bank of the United States and the Government of the United States Interrelate

In an unpublished and previously unknown decision, he finds that the powers of the Bank are limited vis a vis the U.S. government

Likely the only autograph manuscript judicial opinion of Marshall as Chief justice issued to the U.S. government in private hands

In the aftermath of the War of 1812, the U.S. had a formidable debt. Inflation surged ever upward due to the ever-increasing amount of notes issued by private banks, and hard money...

Explore & Discover

- The Chief Justice - This document was signed by Marshall as Chief Justice and he writes here his title

- The Secretary of the Treasury - Marshall has issued this remarkable opinion to the Secretary of the Treasury, a connection from Chief Justice to powerful Cabinet official we have never previously seen

- The Power - Here Marshall is commenting on the relationship, the division of powers and responsibilities, between the US Government and the 2nd Bank

- The Scope - Marshall's level of detail in this 3-page document is extensive and specific, showing grasp of the subject

Likely the only autograph manuscript judicial opinion of Marshall as Chief justice issued to the U.S. government in private hands

In the aftermath of the War of 1812, the U.S. had a formidable debt. Inflation surged ever upward due to the ever-increasing amount of notes issued by private banks, and hard money was jealously hoarded. The Federal government suffered from the disarray of unregulated currency and money supply, and a lack of fiscal order and stability. Many people thought that a national bank would provide relief for the country’s ailing economy, help in paying its war debt, control inflation, and solve its national financial woes. Pressing to establish a second Bank of the United States were businessmen like financiers John Jacob Astor and Stephen Girard, and political leaders like Secretary of the Treasury Alexander Dallas, and Representative John C. Calhoun of South Carolina, who was chairman of the House Committee on the Currency. President James Madison felt that the time had come for Congress to move the country toward a more uniform paper currency, and that a bank would also aid in the resumption of trade and in dealing with war debt.

The political climate – dubbed the Era of Good Feelings – favored the development of national programs and institutions such as a national bank, and at that time a protective tariff to encourage industry was also passed and internal improvements like roads and canals considered. The Second Bank of the United States (BUS), modeled on Alexander Hamilton’s First Bank of the United States, was chartered by President Madison on April 10, 1816. It began operations at its main branch in Philadelphia on January 7, 1817, and just two months later, on March 4, 1817, Madison left office. James Monroe became President and William H. Crawford Secretary of the Treasury, and implementation of the bank would lie in their hands.

The BUS was launched in the midst of a major global market readjustment as Europe recovered from the Napoleonic Wars. The central bank was charged with restraining uninhibited private bank note issue – already in progress – that threatened to create a credit bubble and the brought risk of a financial collapse. Government land sales in the West, fueled by European demand for agricultural products, increased concern that a speculative bubble might form. The public debt was high, depreciated bank notes were out in too great a number, and taxes were insufficient. The western branches of the BUS, and other branches existing where no official branch had been established, were issuing a large number of notes against which the specie of gold or silver did not exist, meaning that a sudden run on funds could crash the system. The task of Monroe, and the primary task of Crawford, was to re-establish sound credit and to bolster a teetering financial system.

William Jones was the President of the Bank, and by all accounts his mismanagement led to the bank’s needing more funds. One means of gathering income for the bank was the sale of its stock, which Jones and his cronies sought to do. Moreover, they hoped to inflate the value of the stock being sold to bring in more revenue. But the Act of Congress chartering the BUS included stipulations that the government first had the right to purchase at a defined rate before that stock was sold privately, and limited to $2 million per annum the amount of stock that might be sold. In 1817, therefore, Crawford informed the BUS that it would be purchasing the $2 million in stock that Jones aimed to sell. This Crawford knew would engender opposition, as it exhausted the amount of stock the bank could clearly sell, and prevented the stock value from being inflated. This situation, described in John Quincy Adams memoirs, induced Crawford to ask Chief Justice John Marshall (who was also a board member of the Bank’s sinking fund, which presided over its cash), to give his opinion on the Constitutional validity of the US government buying this stock in its bank in this way. The legal questions would include the powers of the BUS, as against the U.S. government. Chief Justice Marshall issued this opinion on the legality of this important financial question, communicating it directly to the Secretary of the Treasury.

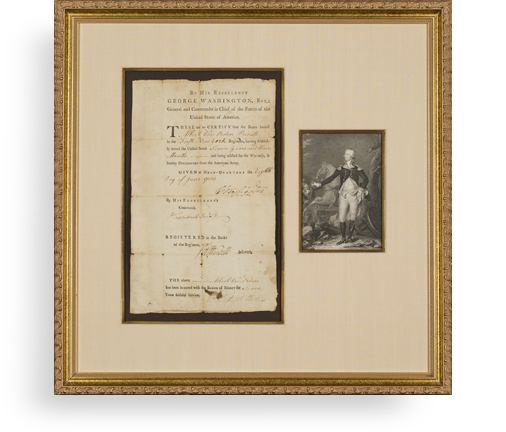

Autograph legal opinion signed, by John Marshall in the 3rd person, undated but clearly in relation to this 1817 incident, 3 pages. “The Chief Justice, as one of the commissioners of the sinking fund, submits to the consideration of the Secretary of the Treasury, in answer to his inquiry, the following opinion on the fifth section of the act for incorporating the Bank of the United States… If the act contained no limitation on the power of either, that which was first exercised would necessarily so far limit the other. If for example the United States should redeem 1 million of the debt, it is obvious that the bank would not afterwards sell the debt so redeemed; and if the bank should sell 1 million, that million would not be distinguishable from the mass of debt in circulation and would immediately resume its original character and qualities. On any other construction the one or the other power would be defeated. But the power of the bank to sell is limited. They cannot sell more than 2 millions of dollars in any one year, ‘nor sell any part thereof at any time within the United States, without previously giving notice of their situation to the Secretary of the Treasury, and offering the same to the United States for the period of 15 days at least, at the current price not excluding the rates aforesaid.’ Should the bank sell more than 2 millions in any one year such sale would transcend its power, but a sale to the amount of 2 millions if made without the United States is I think entirely unexceptionable. The debt so sold mixes with the general mass as if it had never been part of the capital of the Bank. If the sales be made within the United States an additional restriction is imposed on the power. The debt must be first offered to the Secretary of the Treasury. If he consents to become the purchaser, the transaction is closed. He may purchase at less than the rates fixed in the act if the current price be less. The portion of the debt so sold could no longer be acted upon by the power of the Secretary to redeem. Should he decline purchasing, the Bank is at liberty to sell to any other person. To me it seems that the power of the Secretary to redeem this portion of the debt is gone forever in like manner as if he had been himself the purchaser. The two powers check and limit each other so far as neither is limited by the act. If either was to remain in full force to act on the portion of that on which the other had acted previously lawfully, the other would be useless.”

Thus, he found that the power of the BUS was limited, that it could only sell so much stock per year, and that the U.S. could purchase the stock.

Autograph manuscript opinions of John Marshall are extremely rare, this being one of just two that we have seen. The other, not issued to the U.S. government, is in an institution, making this likely his only opinion to the U.S. government in private hands. Crawford retained this manuscript, which is apparently unpublished and previously unknown. We obtained it directly from a Crawford heir, and it has never before been offered for sale.

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services