As Hamilton Works to Pay Off War Debt and Establish the Nation’s Financial System, He Writes, “It is matter of much moment that early information of the product of the Duties should be received by the Treasury”

A wide-ranging letter showing the great mind and organizational power of the nation’s first Treasury of the Secretary

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise monies. A main goal of the new U.S. Constitution was the correction of that defect, and with the support of advocates like Alexander Hamilton and James Madison, it...

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise monies. A main goal of the new U.S. Constitution was the correction of that defect, and with the support of advocates like Alexander Hamilton and James Madison, it established a means to fund the country by authorizing Congress to collect taxes to raise revenue. This revenue would come mainly from tariffs and tonnage duties on goods coming into the U.S., which would be collected at customs houses at the ports of entry. On July 4, 1789, an act was passed formalizing this, allowing for the collection of import duties. The Collectors of these customs houses were appointed by President George Washington, and were men of substance who could be relied on (for example, Signer of the Declaration of Independence William Ellery was the first Collector in Newport, R.I.). In September of 1789, in one of the first substantial Acts of Congress passed and signed by President Washington, the U.S. Treasury was formed. That same month, Alexander Hamilton became the first U.S. Treasury Secretary. This put in place an agency to handle the nation’s finances.

Having the national government pay off all the war debt, including that of the states, was a key part of Hamilton’s financial program. The challenge that Hamilton faced was to raise sufficient monies for that purpose, and to grow the nation’s revenue to pay for U.S. government operations. This was no small task. The genius of Hamilton lay in part on his skill in organization, and to accomplish that task required information that only the Collectors had. He needed to gather this information from all around the country, respecting the revenue that was coming in from duties on imports, exports, and related matters.

Printed letter signed, Treasury Department, October 12, 1792 to one of his collectors. “Sir, I request that henceforth immediately at the close of every quarter, you will furnish me with a summary of the amount of all Duties, which shall have accrued in your Office, during such quarter. It will at the same time be requisite to state the Drawbacks (if any) and the payments to Inspectors and other charges by computation, where the true amount cannot immediately be ascertained, in order to know the net proceeds of the Duties as nearly as may be practicable. In all cases where the returns for any past quarter have not yet been transmitted to the Treasury, it will be necessary that the summary statement be forwarded without delay. It is matter of much moment that early information of the product of the Duties should be received by the Treasury; which renders a careful attention to this instruction particularly necessary.

“It has occurred that vessels bound to foreign ports have by distress of weather been compelled to put into ports of the United States, where upon proper examination such vessels were found to be unfit to proceed on their voyages, so as to render the transferring of their cargoes to other vessels necessary, and a question has arisen, whether such vessels are liable to the Tonnage duty.

“I am of opinion that under those circumstances no Tonnage duty is to be demanded. But regular entries must be made of the cargoes, the Duties paid or secured, and the proceedings for drawing back the Duties must be as in other cases of re-exportation.”

Frame, Display, Preserve

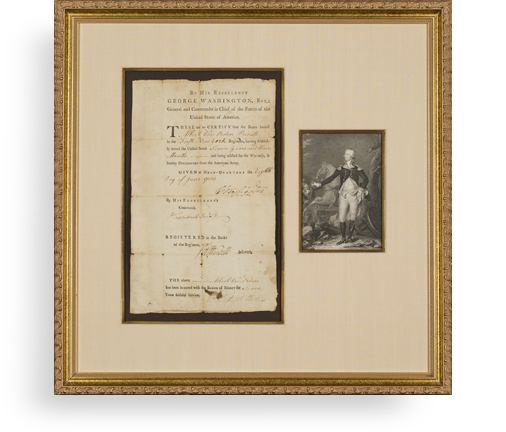

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services