Treasury Secretary Alexander Hamilton Writes Detailed Instructions on Revenue Collection For One of the First Laws Passed by Congress

In 1792, Hamilton felt he had to make sure he knew what was really on the vessel to assess the appropriate tariff, a key part of his financial system

We have never seen another of this letter reach the market

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise monies. A main goal of the new U.S. Constitution was the correction of that defect, and with...

We have never seen another of this letter reach the market

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise monies. A main goal of the new U.S. Constitution was the correction of that defect, and with the support of advocates like Alexander Hamilton and James Madison, it established a means to fund the country by authorizing Congress to collect taxes to raise revenue. This revenue would come mainly from tariffs and tonnage duties on goods coming into the U.S., which would be collected at customs houses at the ports of entry. On July 4, 1789, an act was passed formalizing this, allowing for the collection of import duties. The Collectors of these customs houses were appointed by President George Washington, and were men of substance who could be relied on (for example, Signer of the Declaration of Independence William Ellery was the first Collector in Newport, R.I.). In September of 1789, in one of the first substantial Acts of Congress passed and signed by President Washington, the U.S. Treasury was formed. That same month, Alexander Hamilton became the first U.S. Treasury Secretary. This put in place an agency to handle the nation’s finances.

Hamilton turned to creating a system that would stand the test of time. The customs houses scattered in the many port towns throughout the states were the front lines, assessing and measuring cargo, determining value, and collecting the taxes, as well as disbursing funds.

In August of 1789, in one of the first acts of the First Congress, representatives passed “An Act to provide more effectually for the collection of the duties imposed by law on goods, wares and merchandise imported into the United States, and on the tonnage of ships or vessels.” This was designed to establish Hamilton’s financial system.

One of the main issues this August law helped to settle was to establish what was on board vessels, setting down the basis on which the tariff was to be imposed. This was central to the collection efforts.

In 1792, Hamilton felt that circumstances dictated that he clarify the procedure so that the collectors would know what was really on the vessels to assess the appropriate tariff. Hamilton wrote this circular letter to his collectors. We have never seen another reach the market.

Letter signed, Treasury Department, Philadelphia, June 11, 1792.

“Sir, Some misapprehension having arisen in regard to the provisions concerning Manifests, contained in the 9, 10, 11 and 12th sections of the Collection Law, it becomes proper to enter into certain explanations—to convey the sense and expectations of this Department on the subject.

“It occurs, in the first place, that these Manifests are only required, where vessels are owned in whole or part by Citizens or Inhabitants of the United States. There is therefore, no hardship imposed on persons, who, from situation, are likely to be ignorant of the law.

“Secondly. Though nothing is said in either of the above enumerated sections, that would not be satisfied, if the Manifests were on board, and ready to be delivered upon the arrival of a vessel within four leagues of the coast of the United States, whether they were made out at the place of departure, or at sea; yet it is clear, from express words in the 16th section, that they ought to be on board at the time of the departure of the vessel from the foreign port or place, at which her cargo was taken in. The general design of the provision, equally with the words alluded to, require this construction.

“If, therefore, it appears that no Manifests were on board at the time of the departure of the vessel from the foreign port or place, where her Cargo was taken in, it will become the duty of the officers to enforce the penalties of the act (which are found in the 10 and 12th sections)3 subject to the powers of mitigation and remission, vested in the Secretary of the Treasury. Here will be room for a liberal attention to the difficulties which are natural to the first execution of new regulations.

“The proviso to the 10th section is a further mean of giving an accommodating operation to the regulation; taking care not to defeat the main design. If the Manifests have once been on board, and have been lost or mislaid without fraud or collusion; if they have been defaced by accident, or, if they are incorrect, through mistake, in each of these cases, the forfeiture is remitted, and the Collector is, in the first instance, the judge.

“If any circumstances, therefore, required by the 9th section, are omitted—if any parcels of the cargo should not be included in the Manifests—if, upon the whole, the omission can be fairly ascribed to misapprehension, inadvertence, hurry or mistake, there is latitude to avoid a rigorous enforcing of the provision; and it is incumbent upon the Collector to make reasonable and due allowances, having regard to the usual course of business.

“It has been suggested that it is impracticable to comply with some of the requisitions of the 9th section. That which respects the expressing of the marks and numbers of packages, in words at length, is particularly mentioned.

“On a review of these requisitions, understood as they ought to be, I do not perceive any real impracticability in any of them. That which requires the expression of marks and numbers, in words at length, is the most questionable of any, and it must be confessed, that where the numbers are unconnected, and the packages numerous, it might occasion a prolixity which would amount to an inconvenience; but where the numbers are in succession, the execution would be both simple and easy.

For example—

20 Bales of Cotton,

P. S.

No. 1 to 20 +

G. which is the usual mode,

would be easily expressed thus:

Twenty Bales of Cotton,

P. S.

No. one to twenty +

G.

“The marks would be expressed in both cases alike; because, on a reasonable construction, it cannot be intended that marks, consisting of letters, are to be expressed in words; still less, that mere characters, which have no absolute signification, shall be so expressed; as, in the example given, the +. The terms of every legal provision are to be taken in a reasonable and practicable sense, and so as not to involve impossibility or absurdity. If a literal execution be not practicable, it must be approached as nearly as is practicable, pursuing the general intent, and securing a substantial conformity.

“But there are cases, in which a provision, though not strictly impracticable, may be so inconvenient as to demand some degree of relaxation. And where the question relates to collateral precautions in Revenue laws, for the security of the Revenue, small deviations from literal strictness may, with due circumspection, be admitted. I will only observe that such deviations ought to be really necessary ones—such, without which the essential course of business might be disturbed, and oppression ensue—and ought to be as seldom, and as little as possible.

“A question occurs, as to the tenor of the oath prescribed by the 16th section, as it relates to the subject of Manifests. The Master or Commander of the vessel is, in the cases in which Manifests are required to be on Board, to deliver them to the Collector to whom he makes Report,—and to declare to the truth of them “as they ought to be in conformity to the directions of the act.”

“It is to be observed that the precise form of the oath is not prescribed in the law—and is, therefore, left to be devised by those who are to administer it. It is of course to be so framed as to include whatever is directed to be included in it, and no more; but where general terms are used, the particulars which they appear, from the law, to be intended to comprise may be substituted. It would be dangerous, and might lead to unintentional perjury, to oblige a Master or Commander to swear that the Manifests, which he delivers, are, “as they ought to be, in conformity to the directions of the Act.”

“The declaration ought, therefore, to express, in substance, that the Manifests, produced and delivered, “contain a true, just and particular account of the cargo, which was on board the vessel at the time of her departure from the foreign port, (naming it) from which she last sailed for the United States, and that all matters and particulars, therein expressed, are true.” What these particulars ought to be must be determined by the directions of the 9th section.

“The evidence on which the law appears to rely, as to the fact of the Manifests being on Board at the foreign port of departure, is their being ready to be delivered, upon demand, at any time after the vessel arrives within four leagues of the Coast of the United States.

“This, however, would not exclude the admission of other evidence, if there should be any other.

“It is observable, that the Act speaks of one or more Manifests, in reference to the same vessel. This is to give greater scope to conform to circumstances. A part of the Cargo may be taken in at one port, and a Manifest made out there; another part, at another port, and another Manifest made out there. Or a Master may have supposed her loading complete, and prepared his Manifest, and he may afterwards take in other articles, and have to make a supplementary one—or there may be reasons of commerce for not including all the Cargo in one Manifest.

“This regulation concerning Manifests is considered as of real importance to the Revenue. It will tend, by early ascertaining the true condition of vessels, to prevent plans for smuggling being concerted, after their arrival within the United States, and will be a considerable restraint upon the use of opportunities, which may present between the time of arrival upon the coast, and the final entry at the port of destination.

“It is, therefore, expected that careful attention will be paid every where to its observance; with the qualifications, which have been indicated, to avoid any thing that might justly be deemed a grievance.

“If the Merchants are made sensible that a compliance is expected, (and pains should be taken to inform them of what is expected) they can, without inconvenience, cause it to be effected by proper instructions to their Masters and Correspondents. A Manifest can surely be as well made out before the departure, as after the arrival of a vessel,—inaccuracies, in both cases, are to be expected, and due allowances made for them.

“The 16th section of the Collection Law, considers the report of the Master as a distinct thing from the rendering of a Manifest.6 But in every case the Manifest may constitute the principal part of the report, which may be annexed to the Manifest, with a reference to it; specifying such other particulars, required to be in the report, as may not be expressed in the Manifest. This will be a perfect compliance with the provision, and will save trouble.”

An incredibly detailed, long letter of Hamilton, and we have never seen another example reach the market. Professional conserved.

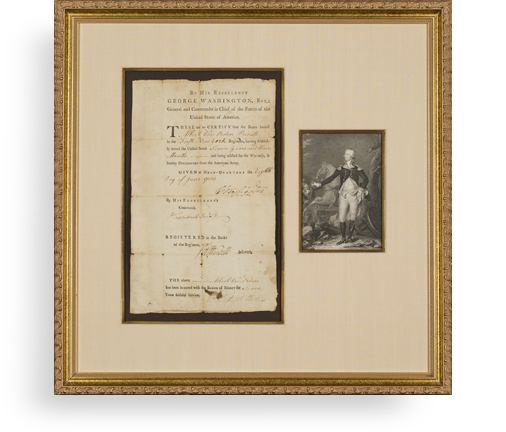

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services