Secretary of the Treasury Alexander Hamilton Wants More Orderly Reporting of Vessels and Exports

He gives his opinion on the taxing of imported spirits

This document has never before been offered for sale

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise money. A main goal of the new U.S. Constitution was the correction of that defect, and with the support...

This document has never before been offered for sale

During the Revolutionary War, it was a widely understood defect in the Articles of Confederation that the Federal government was virtually powerless to raise money. A main goal of the new U.S. Constitution was the correction of that defect, and with the support of advocates like Alexander Hamilton and James Madison, it established a means to fund the country by authorizing Congress to collect taxes to raise revenue. This revenue would come principally from tariffs and tonnage duties on goods coming into the U.S., which would be collected at customs houses at the ports of entry. On July 4, 1789, an act was passed formalizing this procedure by allowing for the collection of import duties. The Collectors of these customs houses were appointed by President Washington, and were men of substance who could be relied on (for example, Signer of the Declaration of Independence William Ellery was the first Collector in Newport, R.I.). In September of 1789, in one of the first substantial Acts of Congress passed and signed by President Washington, the U.S. Treasury was formed. That same month, Alexander Hamilton became the first U.S. Treasury Secretary. This put in place an agency to handle the nation’s finances.

The nation was divided into trade districts centered around a port, and the vessels coming in and our were documented for the purpose of revenue collection. This means understanding what was coming and going in the vessels and communicating to the central office. Hamilton was a detail oriented person and wanted his information presented accurately, well and easily digestible.

In some cases, he went farther than simply instructing his collectors. He sent them a form to fill out, supplying the information he wanted collected and specifying the order.

This happened in 1792, when he wanted information on the return of exports sent abroad and repatriated. Another key element of this was correctly assessing not only the vessels going back and forth from international destinations but also the vessels plying the shores, engaged in domestic trade and in fishing.

Here he begins by providing details on export reporting, and later provides his opinion on the taxing of spirits arriving from abroad. In the middle, he explains how he would like to the fishing and coasting vessels to be recorded.

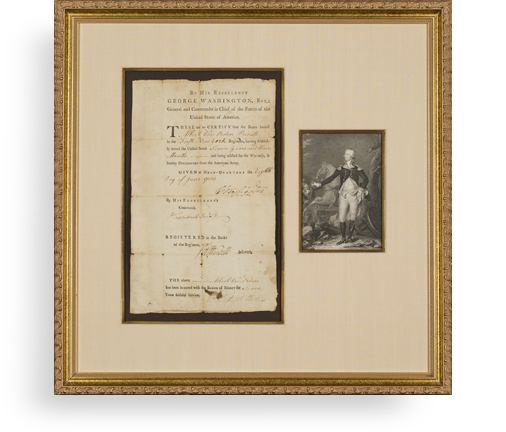

Printed letter signed, Treasury Department letterhead, August 27, 1792, to Stephen Smith, Collector of the port at Machias, Maine. “It would be of use in regard to the Return of exports, which is transmitted quarterly to this Office by the Collectors, if the exported articles were uniformly arranged in alphabetic order.

“With a view to this, I enclose you a form of such an alphabetical arrangement, and request that for the future you will have the articles of exports inserted in the said Return, agreeably to that form; expressing the different quantities of each article as therein prescribed. In all other respects the form of the Return of Exports will remain as heretofore.

“I have to desire that you will furnish me with a monthly abstract of all Licenses which shall be granted to coasting and fishing vessels in your district, to be forwarded after the expiration of every month. The annexed form will shew the particulars to be inserted. It is of course not required that copies or duplicates of Licenses should be transmitted to the Treasury, as has been done in some instances.

“A difference of opinion between the Collectors and Supervisors has occurred in regard to the seventh section of the Act “concerning the Duties on Spirits distilled within the United States, &c.” The true construction is, that the abatement of two per cent. for leakage, is to be made, on securing the Duty at the end of the quarter from the whole quantity distilled during the preceding three months—and hence it will be necessary that in cases of exportation, the Drawbacks on distilled Spirits be adjusted with an eye to this allowance.

“A doubt has arisen on the 35th, or more properly the 36th Section of the Collection Law, whether molasses is to be considered as within the meaning of that Section. I am of opinion, it is, and that the allowance of two per cent. for leakage ought to be extended to that article.”

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services