Sold – Jefferson Certifies an Act of Congress To Settle Debts of the US Government

Act was part of Treasury Secretary Alexander Hamilton's economic plan.

When in 1789 Congress first assembled under the new Constitution to launch the United States, it had one overriding concern: money – where to find it and how to collect it. Without its own source of reliable funds, the U.S. Government would be weak and ineffectual, and its very independence, secured...

When in 1789 Congress first assembled under the new Constitution to launch the United States, it had one overriding concern: money – where to find it and how to collect it. Without its own source of reliable funds, the U.S. Government would be weak and ineffectual, and its very independence, secured through such sacrifice, would be difficult to maintain.

Thus, the first substantive subject taken up in the House of Representatives was a plan of James Madison that would eventually make the nation solvent – impose a duty on imports and create a well-managed agency to ensure its collection. Responding to the urgent need for revenue, Congress quickly passed, and President Washington signed, three laws which together constituted the customs program – the Tariff Act, the Duties on Tonnage Act and the Regulation of the Collection of Duties Act. All were passed and signed in July 1789, and after a law passed in early June governing procedures, they accounted for three of the first four acts passed by the U.S. Congress. These laws establishing a revenue-generating mechanism were considered so important that the press of the day hailed them as a "second Declaration of Independence." They were followed by “An Act for laying a duty on goods…for the discharge of the debts of the United States, and the encouragement and protection of manufactures.” This set specific duties, ear-marked the money for discharge of debt, and added the purpose of encouraging American manufactures.

Alexander Hamilton, the new Secretary of the Treasury, believed that if the nation was to grow and prosper, its credit and commercial economy would have to be sound to encourage both foreign and domestic investment. In his "Report on Credit" on January 14, 1790, he specified a threefold program. First, the government should pay off the war bonds it had issued. To fail to do so, he argued, would establish the federal government as a bad debtor. Second, the government should assume the debts of the states. Although many argued that this was another unnecessary expansion of central government, Hamilton argued that to have all states manage their debts was inefficient and ineffectual. Finally, he proposed that the government establish a steady revenue stream based on taxation of imported goods.

Thomas Jefferson and Virginia led the opposition to Hamilton’s entire program, and most particularly the assumption of debts. Virginians were also unsettled about the planned location of the federal capital in New York. Hamilton realized he could use this issue as leverage. Late in June 1790, Hamilton met in private with Virginia Congressman James Madison. Adeal was struck: Virginians would support assumption of state debts, and Hamilton and his supporters would approve of moving the capital to its present site on the Potomac River. Although Hamilton's plan was approved, Jefferson remained his bitterest foe and founded a political party to thwart Hamilton’s programs from gaining further ground.

The duties established in 1789 were insufficient for the expanded purpose of financing payment of federal and state debts, so to implement Hamilton’s plan, they had to be raised.

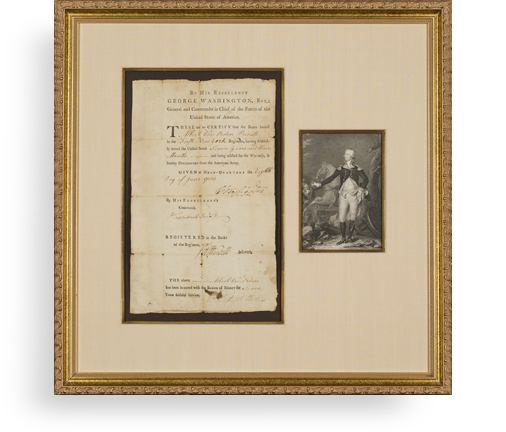

Document Signed, second session of Congress, four pages folio, New York, January 4, 1790, “An Act for the further Provision for the Payment of the Debts of the United States.” This new law taxed wine, tea, cocoa, sugar, cheese, soap, hemp, bricks, china, paper, dye, spices, cotton, wool metal, and scores and scores of other items; in short, practically every conceivable import was taxed. Books, workmen’s tools and scientific equipment were, however, taxed at a lower rate. Another interesting aspect of the law was that goods brought to the U.S. in foreign vessels paid more tax than those arriving on American ships, a way of promoting the fledgling U.S. maritime industry. At the end of the Act, Jefferson, as Secretary of State, certifies this as a“true copy.” One can only imagine the feelings of Hamilton’s arch-foe as he signed this Act of Congress, the very embodiment of Hamilton’s program, raising funds to pay debts Jefferson opposed undertaking, creating high tariffs to benefit those he considered privileged and undeserving, and encouraging industries he feared would undermine the agrarian utopia he dreamt of establishing.

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services