Sold – George Washington Gives Official Notice of the “Second Declaration of Independence”

This was among the first bills considered by the 1st Congress and involved the collection of revenues by the new government.

The Revolutionary War was brought on by customs disputes. The Townsend Acts were passed by Parliament in 1767 to raise money and placed customs duties on colonial imports of lead, glass, paper and tea. The colonies refused to pay the levies claiming they had no obligation to pay taxes imposed by a...

The Revolutionary War was brought on by customs disputes. The Townsend Acts were passed by Parliament in 1767 to raise money and placed customs duties on colonial imports of lead, glass, paper and tea. The colonies refused to pay the levies claiming they had no obligation to pay taxes imposed by a Parliament in which they had no representation. In response, Parliament retracted the taxes with the exception of the duty on tea – this remaining duty demonstrating Parliament’s right to tax the colonies.

The tea tax became the focal point of the colonists’ anger, and in Boston a group of citizens dressed as Indians showed their opposition by dumping tea into the harbor. Colonial resistance had resulted in damage to private property and Britain felt that it could not let this episode (known as the Boston Tea Party) go unpunished. The result in 1774 was the Intolerable Acts, one of which closed the port of Boston. This action, and the resulting determination of the other colonies to make common cause with Massachusetts, led to the calling of the First Continental Congress. The very first grievance cited in that Congress’s resolves related to the imposition of customs taxes.

Less than two years later, the Second Continental Congress debated and passed the Declaration of Independence. It gave as one of the reasons for independence, “imposing Taxes on us without our Consent.” When in 1789 Congress first assembled under the new Constitution to launch the United States on its proper course, it had one overriding concern: money – where to find it and how to collect it.ÊWithout its own source of reliable funds, the U.S. government would be weak and ineffectual, and its very independence, secured through such sacrifice, would be difficult to maintain.

Thus, the first substantive subject taken up in the House of Representatives was a plan of James Madison that would eventually make the nation solvent: impose a duty on imports and create a well-managed agency to ensure its collection. Responding to the urgent need for revenue, Congress quickly passed, and President Washington signed, three laws which together constituted the customs program – the Tariff Act, the Duties on Tonnage Act and the Regulation of the Collection of Duties Act. All were passed and signed in July 1789, and after a law passed in early June governing procedures, they accounted for three of the first four acts passed by the U.S. Congress.

These laws establishing a revenue-generating mechanism were considered so important that the press of the day hailed them as a “second Declaration of Independence.” At the start of the Washington administration, it was the procedure for the President to notify the states of statutes passed by Congress (shortly the Secretary of State would take over this responsibility, and by Adams’ time, it was dispensed with altogether).

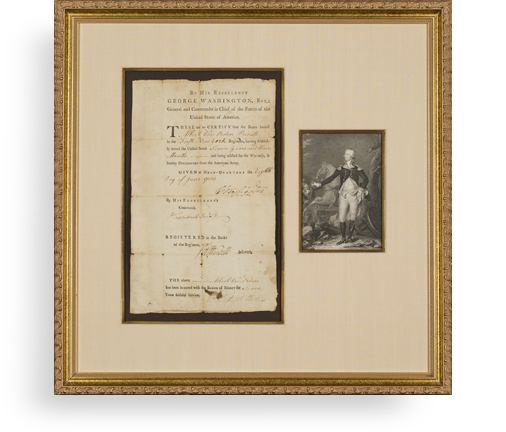

Letter Signed, New York, August 4, 1789, to John Howard, Governor of Maryland, informing him officially of the cap-stone of the customs acts, signed on July 31, 1789. “Agreeably to the Resolution of Congress of the 5th of June, I do myself the honor to enclose to Your Excellency an Act to regulate the Collection of the Duties imposed by Law on the Tonnage of ships or vessels, and on Goods, Wares, and Merchandizes imported into the United States.”

On the verso appears the recipient’s docket: “August 4, 1789. President of United States with an Act to regulate the collection of the Duties imposed by law on the tonnage of ships or vessels, and on goods wares & merchandizes imported into the United States. Received 10th August.” The nation’s capitol was then in New York, and the first vessel to arrive at the port there under the new customs law was the brigantine Persis, from Livorno, Italy, on August 5, 1789. Commanded by James Weeks, she was consigned to one James Seton, who paid the first duty ever collected by U.S. Customs – $774.71. The U.S. Government was in business.

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services