At the Dawn of the Bank of England: William III Sets Economic Precedent in the Modern Western World, Setting British Monetary Policy In the Midst of His Great Financial Forms

He authorizes a committee to “consider the state of the coin” as part of the creation of the authorization of powers of a new English financial structure that has set the global standard.

The earliest document we can find having reached the market related to this type of structured monetary policy

William III appeared upon the scene at a critical juncture in the history of Britain. England's crushing defeat by France, the dominant naval power, in naval engagements culminating in the 1690 Battle of Beachy...

The earliest document we can find having reached the market related to this type of structured monetary policy

William III appeared upon the scene at a critical juncture in the history of Britain. England's crushing defeat by France, the dominant naval power, in naval engagements culminating in the 1690 Battle of Beachy Head, became the catalyst for its rebuilding itself as a global power. England had no choice but to build a powerful navy. The country was passing through a severe monetary as well as a civil and ecclesiastical crisis. Trained in the Netherlands – a country long the emporium of gold and silver transactions – William effected the greatest monetary revolution ever accomplished by a single individual. It was during his time and as the result of the policy he pursued that the Bank of England was established and that the national debt became a settled institution. When he ascended the throne, there did not exist a single corporation entitled to regulate the money of the country, and the national debt amounted to a little more than half a million £. The new ruler however soon made his influence felt and soon also developed a far reaching policy.

The establishment of the bank was devised by Charles Montagu, 1st Earl of Halifax, in 1694, to the plan which had been proposed by William Paterson three years before. He proposed a loan of £1.2m to the government; in return the subscribers would be incorporated as The Governor and Company of the Bank of England, with long-term banking privileges including the issue of notes. The Royal Charter was granted on July 27 through the passage of the Tonnage Act of 1694. Public finances were in so dire a condition at the time that the terms of the loan were that it was to be serviced at a rate of 8% per annum, and there was also a service charge of £4,000 per annum for the management of the loan.

The Government of King William received a loan in gold to the amount of £1,200,000 and gave in exchange for that sum stock paper, and at the same time authorized the Bank to issue its own notes to the amount of that stock. Everything had to be done legally, but whether righteously was another question. The Parliament therefore passed a new Act imposing additional taxes upon the people to pay the interest on the capital borrowed and to redeem the stock, and as it was provided that the Exchequer was to receive the Bank's notes in payment of taxes, the Government returned these notes to the Bank in payment of interest and capital. The stock thus redeemed by the Exchequer was again issued as money and as such circulated by authority of the Government. But this Act also claimed to regulate the operations of the bankers. They were allowed to use gold, silver and bills of exchange and to issue bank notes only as promissory notes. The Bank had now the right of issuing notes that were payable not to any particular person on his order but to the bearer and on demand. These were harmful changes, as was soon apparent. In 1697, only three years after the incorporation of the Bank, the directors were unable to pay their notes unless at a discount of 15-20%.

Thus did William III step into the role of today’s federal reserve or bank chief, managing monetary policy for the Kingdom. In doing so, he sought to set values for English currency and to manage other coins that flooded in as English money left.

Document signed, London, January 28, 1697, setting up a commission to consider the problem of the money supply. “Whereas we are informed that there is a great scarcity of money in our Kingdom and that there may arise inconveniences from the different species of foreign coin imported into it, and particularly from the English hammered money… We do hereby authorize and empower you to consider the state of the coin and as you shall find most proper for the good of our subjects to raise or diminish the value thereof or order the same to pass only according to its intrinsic value….”

With the creation of the Bank of England, which acquired the responsibility to print notes and back them with gold, the idea of monetary policy as independent of executive action began to be established. The goal of monetary policy was to maintain the value of the coinage, print notes that would trade at par to specie, and prevent coins from leaving circulation. The Bank of England remains the central bank of the United Kingdom and the model on which most modern central banks have been based. It is the second oldest central bank in the world, after the Sveriges Riksbank {Swedish Government Bank], and the world's 8th oldest bank.

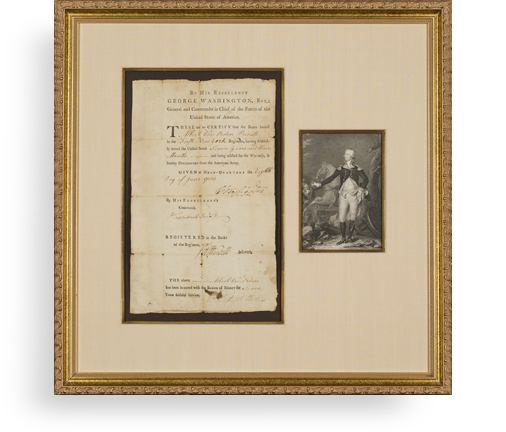

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services