Wolcott and The U.S. Treasury Implement Alexander Hamilton’s Financial System

Following the Revolutionary War, the new nation, its member states, and a great many of its citizens were deeply in debt. In January of 1790, Alexander Hamilton published his “Report on the Public Credit”, in which he argued that the financial health of the nation was essential to its prosperity; and to...

Following the Revolutionary War, the new nation, its member states, and a great many of its citizens were deeply in debt. In January of 1790, Alexander Hamilton published his “Report on the Public Credit”, in which he argued that the financial health of the nation was essential to its prosperity; and to achieve this end, he proposed that all debts were to be paid at face value, the Federal government would assume all of the war debts owed by the 13 states, and the state debts would be paid out of the federal treasury. But rather than just pay the debt load off, he recommended the consolidation of the debts into new securities (stocks, or what we would today consider bonds) with public revenues specifically pledged to pay their interest. Subscribers could obtain and trade these securities and would receive interest from the federal government. Hamilton’s plan proved to be a great success, wiping out a huge debt without a crippling lump sum payment, establishing the credit of the United States both domestically and internationally, encouraging American business, and tying the wealthy class to U.S. government investments.

In 1792, Nathaniel Appleton was the Commissioner of Loans for the US government stationed in Massachusetts. Oliver Wolcott, Jr., son of the Signer of the Declaration of Independence, was the Comptroller of the Treasury under Alexander Hamilton and would succeed him as Secretary in 1795. On March 17, 1792, Appleton wrote to Wolcott sending him an accounting of the interest he had paid on debt in the hands of these government stock subscribers and received this letter from Wolcott in return, acknowledging that and asking for an accounting of how much money remained in the Massachusetts account books.

Letter Signed, Treasury Department, Comptroller's Office, March 28, 1792, to Nathaniel Appleton. "Sir, I have received your letter of the 17th instant with abstracts and vouchers of payments made in the quarter ending on the 31st of December 1791, on the dividend accounts, for the quarters ending on the 31st of September 1791. They should have been accompanied by an account current showing the balance of cash in your hands. You will there be pleased to transmit one as soon as possible. I am, Sir, very respectfully, your obedient servant, Oliver Wolcott."

With free franked envelope signed by Wolcott, addressed to "Nathaniel Appleton Esquire, Commissioner of loans for the state of Massachusetts." Docketed "Comptroller's office, 28 March 1792, acknowledged returns of interest paid to 31 Dec 1791 on interest due 30 september 1791." A glimpse inside the workings of Hamilton's financial system and the new American economy.

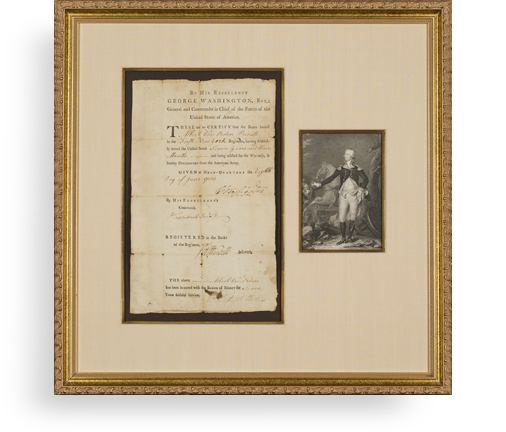

Frame, Display, Preserve

Each frame is custom constructed, using only proper museum archival materials. This includes:The finest frames, tailored to match the document you have chosen. These can period style, antiqued, gilded, wood, etc. Fabric mats, including silk and satin, as well as museum mat board with hand painted bevels. Attachment of the document to the matting to ensure its protection. This "hinging" is done according to archival standards. Protective "glass," or Tru Vue Optium Acrylic glazing, which is shatter resistant, 99% UV protective, and anti-reflective. You benefit from our decades of experience in designing and creating beautiful, compelling, and protective framed historical documents.

Learn more about our Framing Services